27+ turbotax mortgage interest

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million 500000 if you use married filing separately status for tax years prior to 2018. TurboTax Help Intuit Can I deduct mortgage interest.

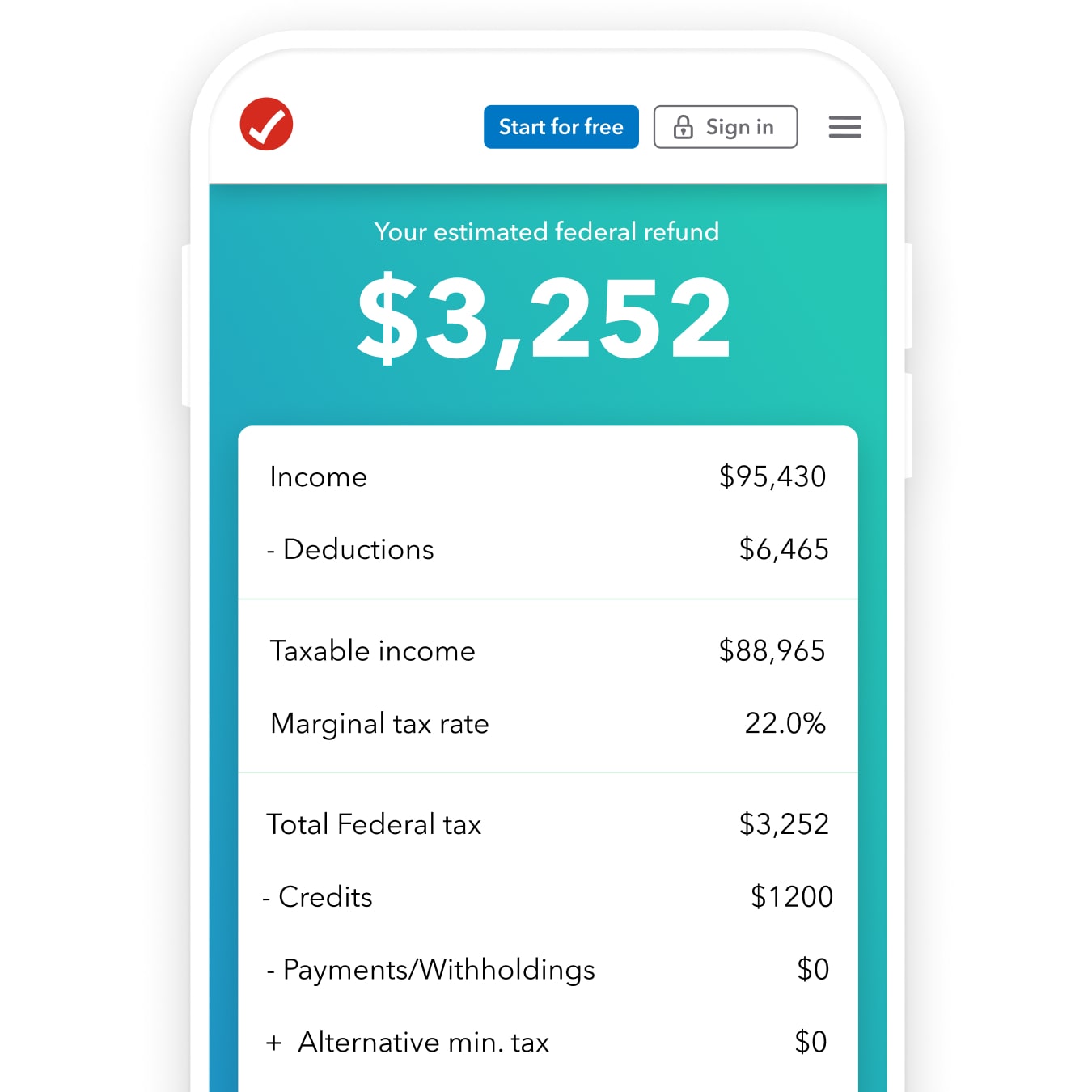

Free Tax Calculators Money Saving Tools 2022 2023 Turbotax Official

Web TurboTax Canada.

. - TurboTax Support Video Watch on Related Information. Mortgages can be considered money loans that are specific to property. The standard deduction is 19400 for those filing as head of household.

SOLVED by TurboTax Duration undefined 165 Updated 1 year ago Can I Deduct Mortgage Interest. These costs are usually deductible in the year that you purchase the home. But if not you can deduct them pro rata over the repayment period.

Web Mortgage discount points also known as prepaid interest are generally the fees you pay at closing to obtain a lower interest rate on your mortgage. In addition to itemizing these conditions must be met for mortgage interest to be deductible. Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals.

Web This article will help you apply home mortgage interest rules calculate mortgage interest deductions and their limitations and input excess mortgage interest amounts into Schedule A in Intuit ProConnect. There are higher limits for homeowners who got mortgages before December 16. Web If you have a mortgage you can take the same deductions for mortgage interest and property taxes.

Web TurboTax Support Community Support TurboTax Credits and deductions Homeownership Can I deduct mortgage interest. When excess home mortgage interest rules apply Calculating excess home mortgage interest deductions. You cant deduct the principal the borrowed money youre paying back.

Homeowners who are married but filing separately may be allowed to deduct up to the first 350000 of their mortgage interest costs. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Beginning in 2018 this limit is lowered to 750000.

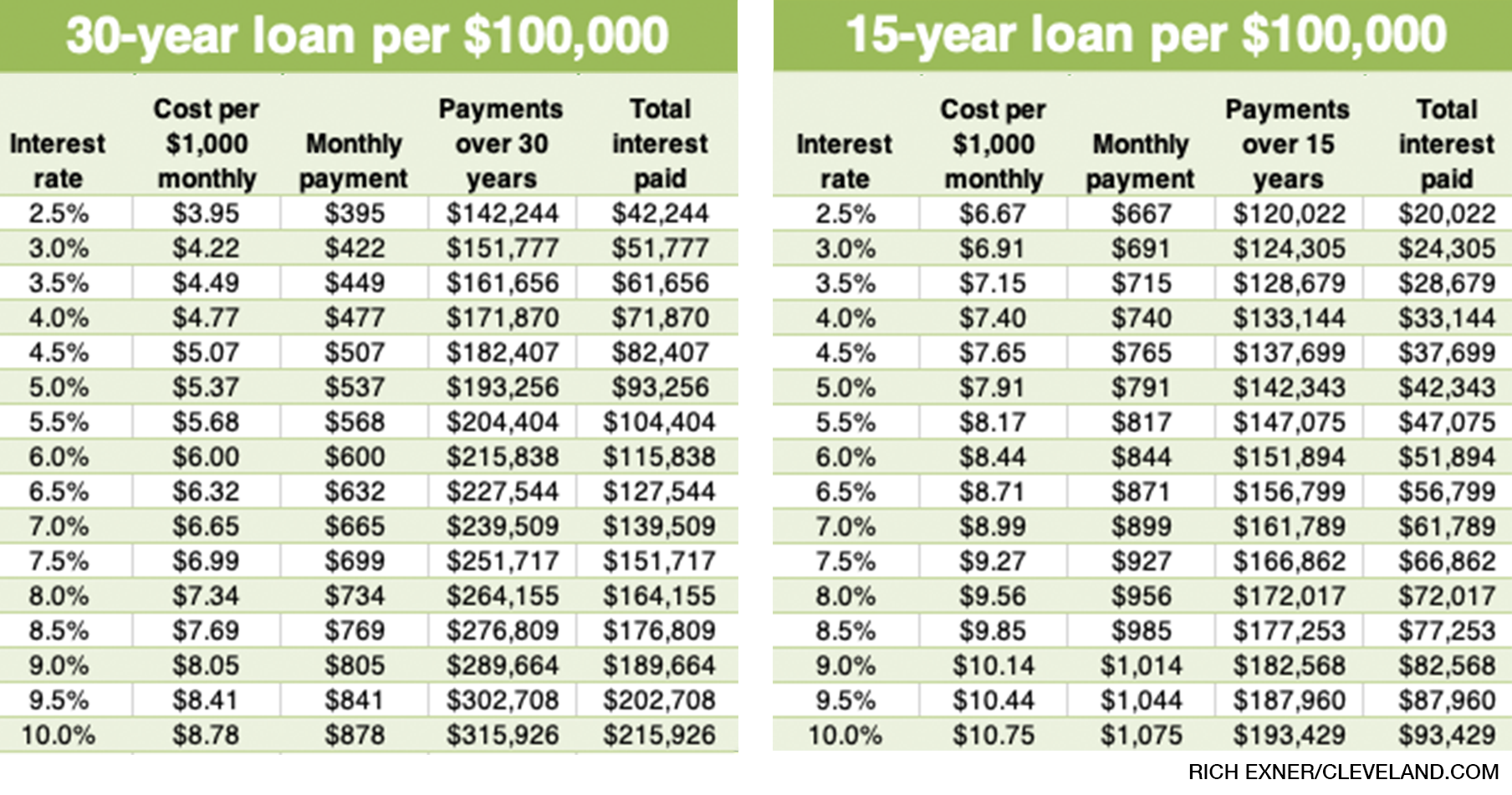

You can connect live via one-way video to a TurboTax Live CPA or Enrolled Agent experience to get your tax questions answered. The average 30-year fixed-mortgage rate is 696 the average rate for a 15-year fixed mortgage is 627 percent and the average rate on a 51 ARM is 580 percent. Web SOLVED by TurboTax 2713 Updated January 13 2023 The IRS lets you deduct your mortgage interest but only if you itemize deductions.

Web Mortgage rates continue to rise. If they are incurred for the purpose of earning income by renting property to tenants the interest portion of the mortgage is deductible on line 8710 of the T776 Rental Income form. If you itemize deductions you could deduct the interest from the amount of your.

Web In this video we demonstrate how to read Form 1098 and how to enter the information into TubroTax in order to take itemized deductions for home mortgage inte. There may be limits due to income and other factors but the fact that its a second home doesnt limit you.

See Why Turbotax Is Great For Simple Tax Returns

2019 Turbo Tax Return Pdf Tax Refund Tax Return United States

Turbotax Review Get A 100 Accuracy Guarantee

7 Best Credit Score Apps That Help You Monitor Your Credit In 2023

A Guide To The 1098 Form And Your Taxes Turbotax Tax Tips Videos

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Amazon Com Old Version Turbotax Premier State 2019 Tax Software Pc Download Everything Else

Online Banking Michigan Credit Union Online Banking Msgcu

How To Avoid Taxes On Canceled Mortgage Debt Turbotax Tax Tips Videos

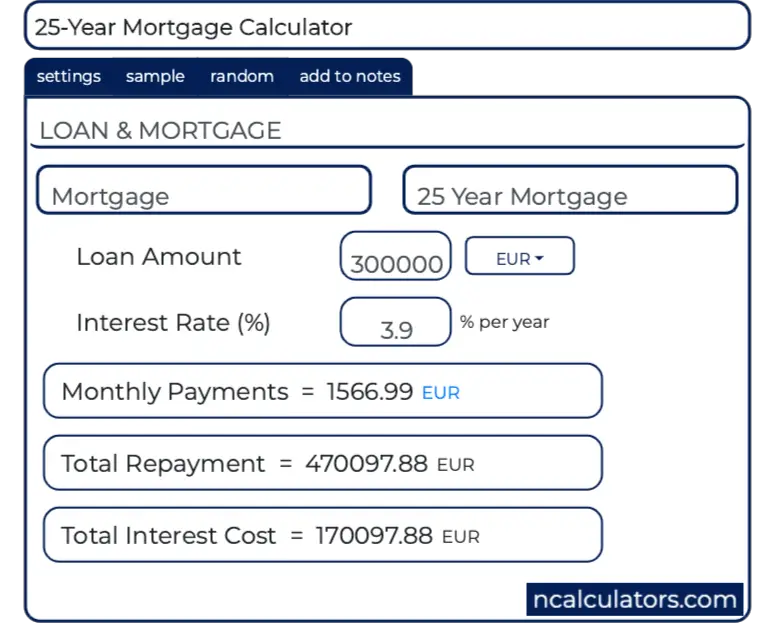

25 Year Mortgage Calculator

See How Well Your Mortgage Interest Deduction Stacks Up Compared To The Rest Of The Country

Intuit Turbotax Deluxe 2021 Federal E File State Windows Mac Cd Download Ebay

Amazon Com Old Version Intuit Turbotax Deluxe 2021 Federal And State Tax Return Pc Download Everything Else

With Mortgage Rates At Historic Lows Should You Join The Rush To Refinance That S Rich Cleveland Com

Amazon Com Turbotax Deluxe Federal E Ffile 2010 Old Version

Amazon Com Turbotax Business 2014 Federal Fed Efile Corp Partnership Estates Trusts Tax Software 424567

How Turbotax Is Screwing You Ramsey